Gold has always been a symbol of wealth, security, and a safe haven during economic uncertainty. For centuries, people have turned to physical gold — gold coins, bars, and jewelry — as a trusted store of value or Investment. However, with financial markets evolving, investors now have another option: Gold Exchange-Traded Funds (ETFs).

If you’re considering investing in gold but can’t decide between physical gold and Gold ETFs, this guide will help you. It will weigh the pros and cons of each. You can then determine which is better for you based on your needs and goals.

Understanding Gold ETFs

Gold ETFs are financial instruments traded on stock exchanges, just like shares of a company. They represent ownership in gold without you needing to store or handle it physically. Each unit of a Gold ETF usually corresponds to 1 gram or a fraction of a gram of gold.

How Gold ETFs Work:

- Backed by Physical Gold: Each unit of a Gold ETF is backed by physical gold held by the fund in secure vaults.

- Traded on Stock Exchanges: You can buy and sell Gold ETFs during market hours at prevailing prices.

- Transparency and Regulation: These funds are regulated by financial authorities, ensuring transparency and reliability.

What Is Physical Gold?

Physical gold refers to tangible gold in the form of jewelry, coins, or bars. It’s the traditional way of owning gold and has been a preferred choice for generations due to its intrinsic value and cultural significance. In India, gold is considered the first form of investment.

Types of Physical Gold Investments:

- Gold Jewelry: Often purchased for personal use or as a gift, with added emotional value.

- Gold Coins: Available in various weights, ideal for small-scale investments.

- Gold Bars: A popular choice for large-scale investors.

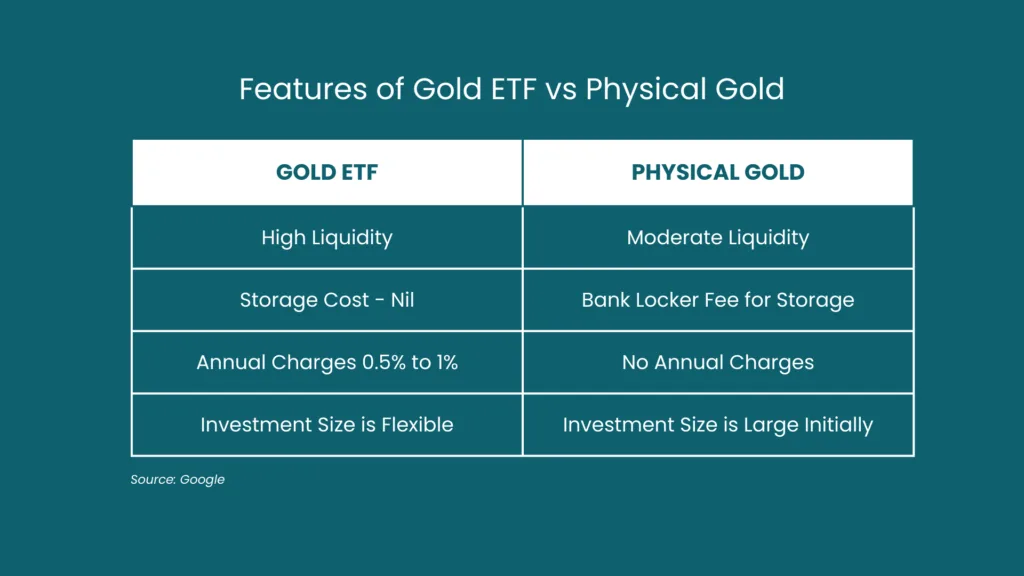

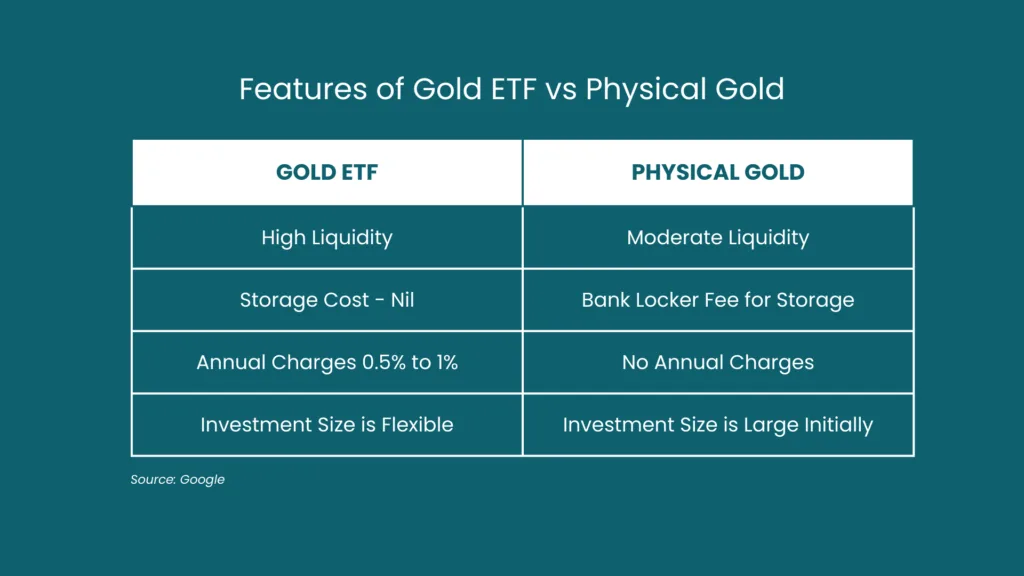

Key Differences Between Gold ETFs and Physical Gold

| Mark | Gold ETFs | Physical Gold |

| Convenience | Investing in Gold ETFs is simple. You just need a Demat account and can buy or sell through online trading platforms. There’s no hassle of safekeeping or purity checks. | Storing physical gold requires secure storage (like a bank locker), and purity assurance is a concern. You must also consider making charges if you’re buying jewelry. |

| Liquidity | Gold ETFs are highly liquid. You can sell them instantly on the stock exchange during trading hours. | Selling physical gold can take time. You must find a buyer. The price may vary depending on market conditions. There are also additional costs like appraisal charges. |

| Costs Involved | Annual fund management fees (typically 0.5%–1%). Brokerage charges when buying or selling. | Making charges (for jewelry). Storage costs (locker fees). Potential loss of value if purity is compromised. |

| Investment Size | Gold ETFs are accessible to all investors. You can start small and buy units worth as little as the price of 1 gram of gold. | Buying physical gold often requires a significant upfront investment, especially for bars or high-quality jewelry. |

| Emotional and Cultural Value | Gold ETFs lack the emotional and cultural connection that physical gold offers. | In many cultures, gold holds symbolic value and is seen as a sign of wealth, prosperity, and security. Jewelry, in particular, is cherished for its emotional significance. |

Benefits of Gold ETFs

1. Transparency in Pricing

Gold ETFs track live gold prices, ensuring you buy or sell at market rates without hidden charges.

2. Easy to Diversify

With Gold ETFs, you can easily balance your portfolio alongside other investments like stocks and bonds.

3. No Storage or Safety Issues

Your investment is safe with the fund house, so you don’t have to worry about theft or damage.

4. Tax Efficiency Gold ETFs attract lower tax liabilities compared to physical gold. Long-term capital gains tax applies after 3 years, with indexation benefits.

Advantages of Physical Gold

1. Tangibility

There’s comfort in owning something tangible. Physical gold offers a sense of security that paper-based assets cannot replicate.

2. Cultural Significance

Physical gold is often gifted during weddings, festivals, and other celebrations, making it more than just an investment.

3. No Dependency on Technology

Unlike Gold ETFs, you don’t need an internet connection, trading account, or digital access to hold physical gold.

4. Universal Acceptance Physical gold is recognized and valued globally, making it a universally accepted form of wealth.

Challenges of Gold ETFs and Physical Gold

Gold ETFs

- Dependence on Stock Market Infrastructure: Gold ETFs require access to a trading account and time during market hours.

- Annual Management Fees: These fees, though minimal, can add up over time. Some taxes, brokerage charges and other charges may add up after every trade. (even small)

Physical Gold

- High Making Charges: Jewelry often comes with 8%–20% additional making charges, which you may not recover during resale.

- Risk of Theft or Loss: Storing physical gold securely requires added precautions, which can be expensive and inconvenient.

- Purity Concerns: Ensuring the authenticity and purity of gold is crucial, and fake gold scams are not uncommon.

Who Should Choose Gold ETFs?

Gold ETFs are ideal for:

- Investors seeking convenience and liquidity: They are easy to buy, sell, and store.

- Those aiming for portfolio diversification: Adding Gold ETFs can hedge against market volatility.

- Tax-conscious investors: Gold ETFs are more tax-efficient than physical gold.

Who Should Opt for Physical Gold?

Physical gold is a better choice for:

- Traditional buyers: If cultural or emotional significance is a priority, physical gold is unmatched.

- Investors without digital access: For those who prefer tangible assets over digital records.

- Long-term wealth preservation: Gold bars and coins are ideal for preserving wealth for future generations.

Which Should You Choose between Gold ETF & Physical Gold?

The decision between Gold ETFs and physical gold depends on your financial goals, lifestyle, and investment preferences.

- Choose Gold ETFs if you want a hassle-free, liquid, and transparent investment tied to gold’s value.

- Opt for physical gold if cultural significance, tangibility, or long-term wealth preservation is more important to you.

Remember, there’s no one-size-fits-all answer. You can also combine both options in your portfolio for added flexibility and diversification. Whichever you choose, gold remains a valuable asset that can protect and grow your wealth over time.

You may also like: Beginner’s Guide to Stock Market & Our Cryptocurrency Guide